Amazon Quarterly Results Q3 2022

On October 27, Amazon announced its third quarter results.

In a nutshell:

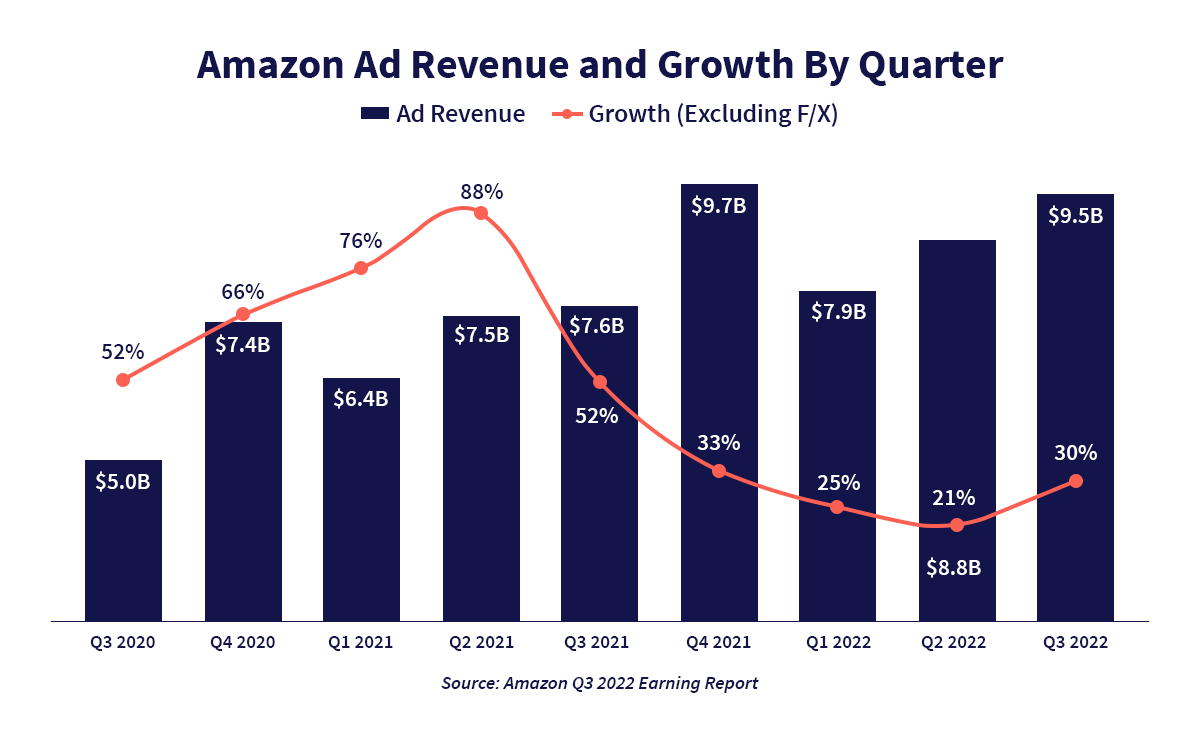

Compared to the previous year, Amazon increased its advertising revenue by 25% to $9.5 billion in the third quarter. This means that the growth rate is once again higher than in the previous period, according to an earnings release.

Amazon's advertising business remains the silver lining as the company struggles with declining numbers in its core businesses. The e-commerce giant issued a weak sales forecast for its most important quarter of the season, adding to general recession fears and worrying investors.

However, momentum remains in terms of advertising spend, as brands are investing more in media channels, especially in the downturn.

To that end, Amazon expanded its suite of advertising products in late October, offering more options around video and advertising technologies with its Data Clean Room called Amazon Marketing Cloud.

Insights:

The macroeconomic environment is facing dark times as consumers will continue to limit their consumer spending, which is fueling a lot of uncertainty at Amazon, especially in relation to the holiday season.

The gloomy outlook, as well as the business results, fit seamlessly into a string of tech results that other digital platforms like Meta and Google are currently suffering from.

Amazon expects net sales for the last and most important quarter to be between $140 billion and $148 billion, well below stock market expectations.

Advertising services only started counting as a separate segment at Amazon earlier this year. However, this development reflects a massive shift in advertising spending to retail media and performance channels.

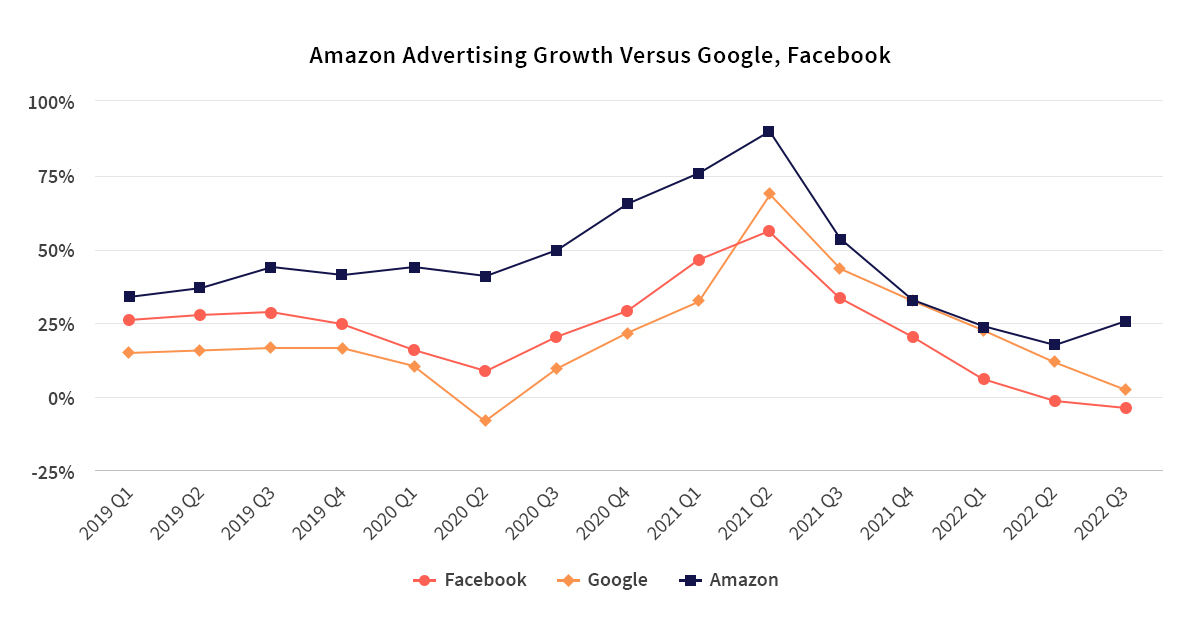

With nearly $10 billion in quarterly advertising revenue, Amazon is far ahead of traditional retailers. While Amazon hasn't quite matched the massive advertising revenues of Google and Meta, it is clearly outperforming its digital competitors.

In contrast to Google, whose advertising revenue, including all Google products like YouTube, grew only 2.5% to $54.4 billion. Facebook, including Instagram, shrank for the second year in a row and is down 3.7% year-over-year to $27.2 billion.

Without question, Google and Facebook are significantly larger. But Amazon Advertising continues to show the potential to catch up in the future. As recently as the third quarter of 2019, Facebook's advertising business was more than six times the size of Amazon Advertising. Within three years, the gap has shrunk to a little less than three times that size.

For brands facing inflationary pressures, Amazon is particularly attractive. With its scale, advanced advertising technologies and ability to provide media placements across its vast e-commerce market, the company offers numerous advantages. This could give Amazon an edge in the Christmas advertising race.

“We’re realistic that there are various factors weighing on people’s wallets, and we’re not quite sure how strong holiday spending will be versus last year. But we know the consumers when they’re looking for good deals, and that positions us well. Advertisers are looking for effective advertising.”

Amazon Chief Financial Officer Brian Olsavsky said this on a conference call to discuss third-quarter results with analysts.